are dental implants tax deductible in 2019

In fact most of the dental expenses you pay for throughout the. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit.

Fantastic Tips To Help You Find The Right Dental Implant Costs To Fit You

If you are 65 or over they are deductible to the extent they.

. Dental expenses can be a big part of an individuals or a familys medical expensesDental procedures such as root canals fillings and repairs and braces can run into the hundreds and even thousands of dollars. Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions includi. Expenses related to OTC toothpaste dental floss mouthwash and general care products are typically not considered tax-deductible either.

May 3 2021 By Staff. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. HealthMarkets makes it easy to get low cost dental or vision plans that fits your individual needs and your budget.

Most non-cosmetic dental expenses are tax deductible. Of course your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund. The second factor involves your adjusted gross income.

This tax season is especially notable because of the Tax Cuts and Jobs Act which took effect in 2018. Cosmetic dentistry can repair fractured broken crooked discolored missing or worn teeth and a percentage of your dental expenses for these procedures are tax deductible. 502 Medical and Dental Expenses.

Cosmetic dentistry covers a wide range of dental procedures used to improve the appearance and functionality of the teeth. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents. The deductible may be carried over.

You may deduct only the amount of your total medical expenses that exceed 7. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20. The annual deductible amount is 25 per covered person and not more than 50 for a family.

You would have to eat the first 3000 of those expenses before it starts lowering your tax obligation. Yes dental implants are an approved medical expense that can be deducted on your return. Lets say you make 40K a year.

May 31 2019 855 PM. This brings us back to the question Are porcelain crowns dental implants and fillings medically necessary. The good news is that will include all of your medical and dental expenses not just your dental implants.

2014 - Medical Foods. Medical expenses in accordance with the amendments to the tax code that took effect on July 1 2019 are not deductible for taxable income for the 2020 tax year. If they were performed to repair damaged teeth and restore oral health the answer is most.

There is a small catch though. To enter your medical expenses go to FederalDeductions and CreditsMedicalMedical Expenses. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you.

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. Yes dental implants are an approved medical expense that can be deducted on your return.

When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021. For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible. You can claim the portion of the procedure that you pay also known as the co-pay.

While dental implants arent specifically mentioned in IRS Publication 502 the IRS says. It would be great if these procedures were all tax deductible but this is not always the case. Are dental implants tax deductible 2019.

22 2022 Published 512 am. If your treatment for implant or cosmetic dentistry is 50000 then 45125 is fully tax deductible. You can only deduct expenses greater than 75 of your income.

That means all types of operations dental work medications dental work benefits medical expenses and disability insurance premiums are no longer tax deductible. Single 12200 1650 65 or older. Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride.

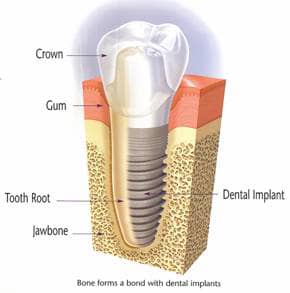

Dental Implants Surgery In Ottawa Argyle Associates

How Often Should A Dental Implant Come Loose Quora

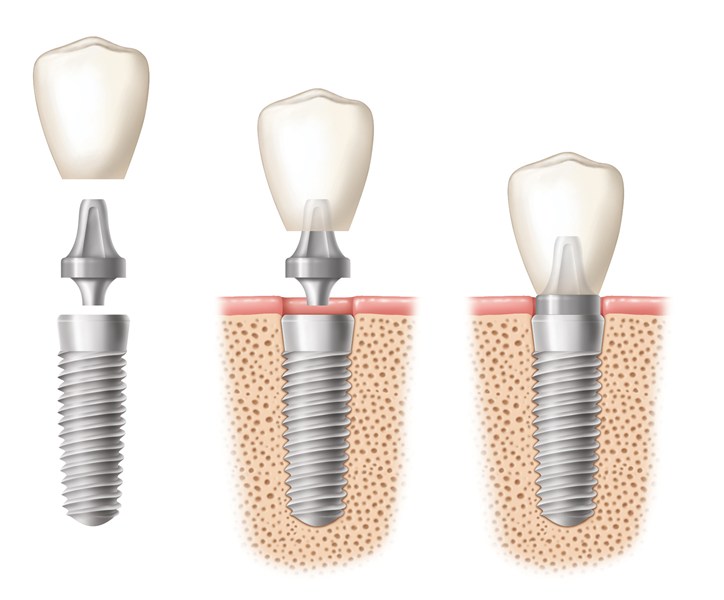

Dental Implants Ident Dental Vaughan Dentistry 905 553 2647

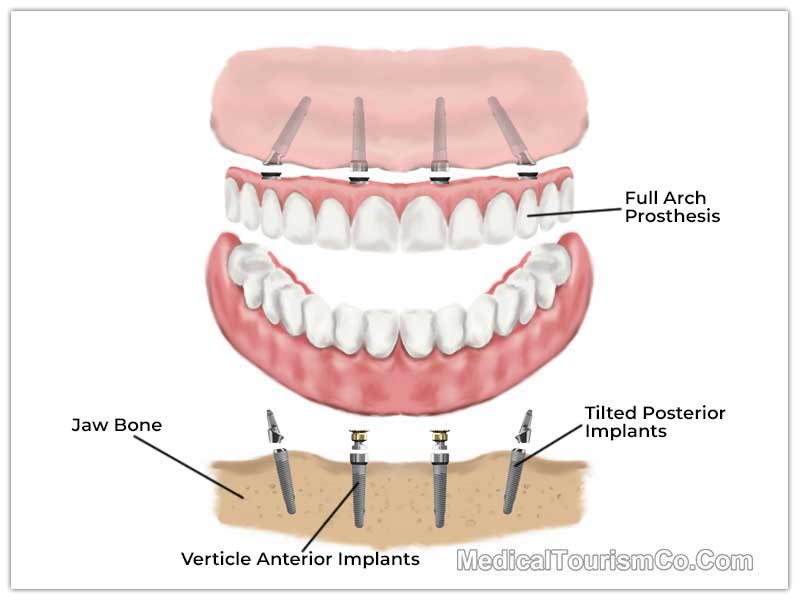

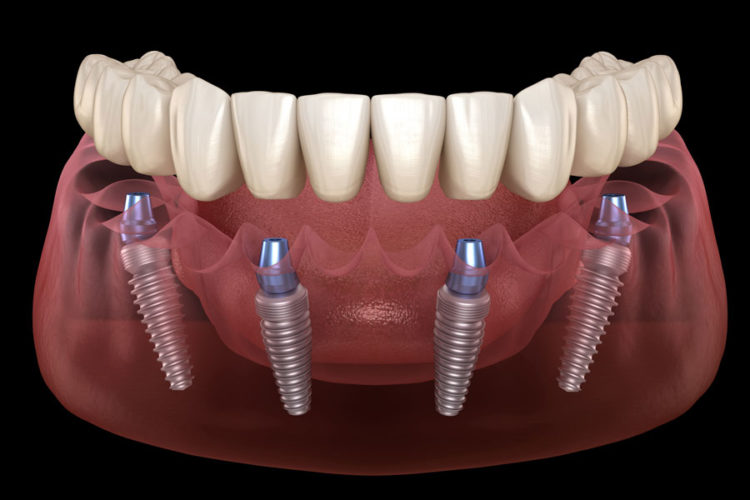

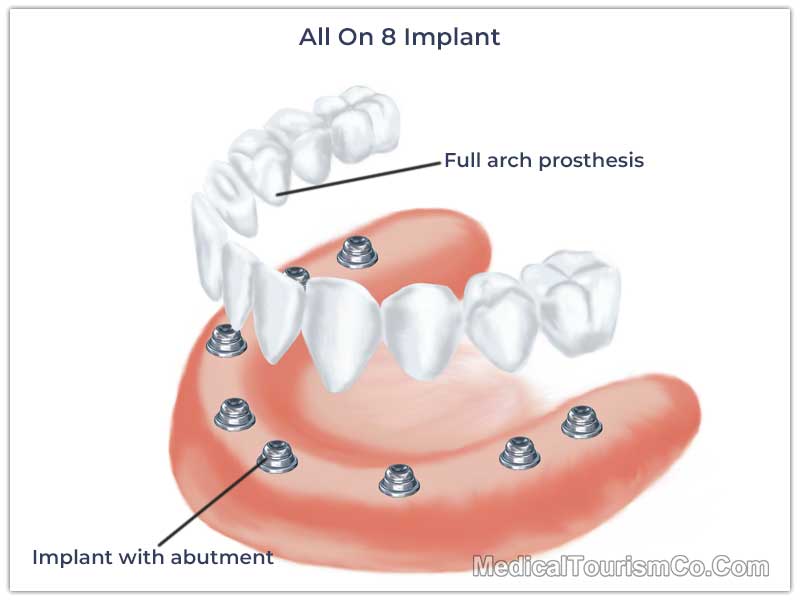

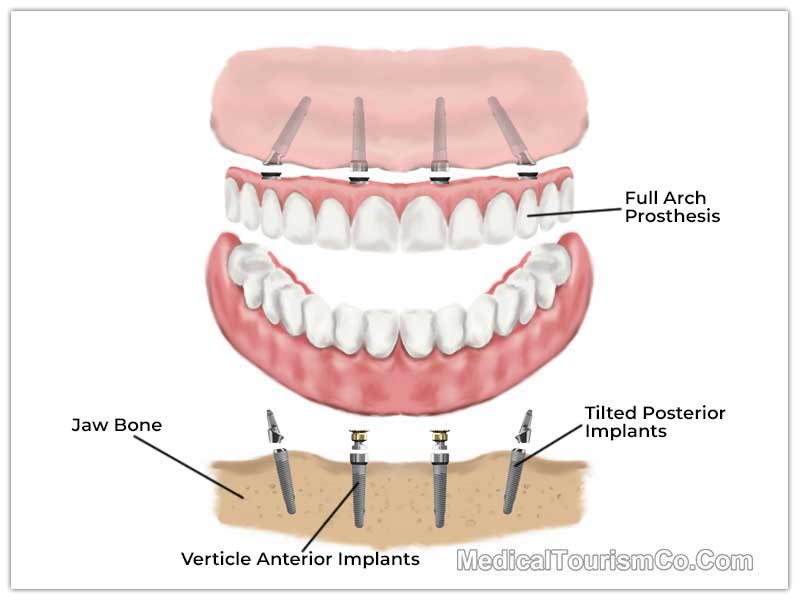

Domestic All On 4 6 Full Arch Implant Surgery Live Patient Program Itc Seminars

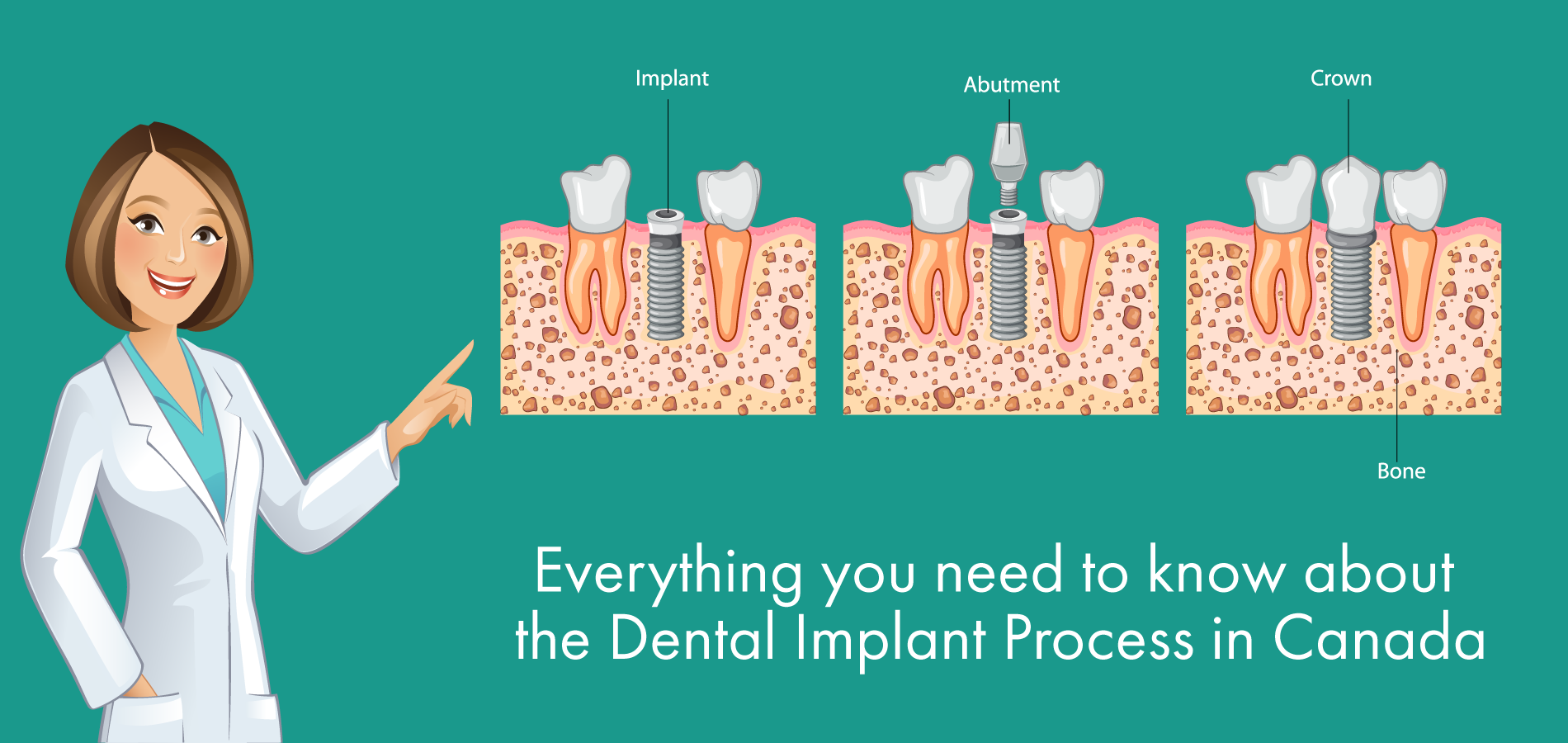

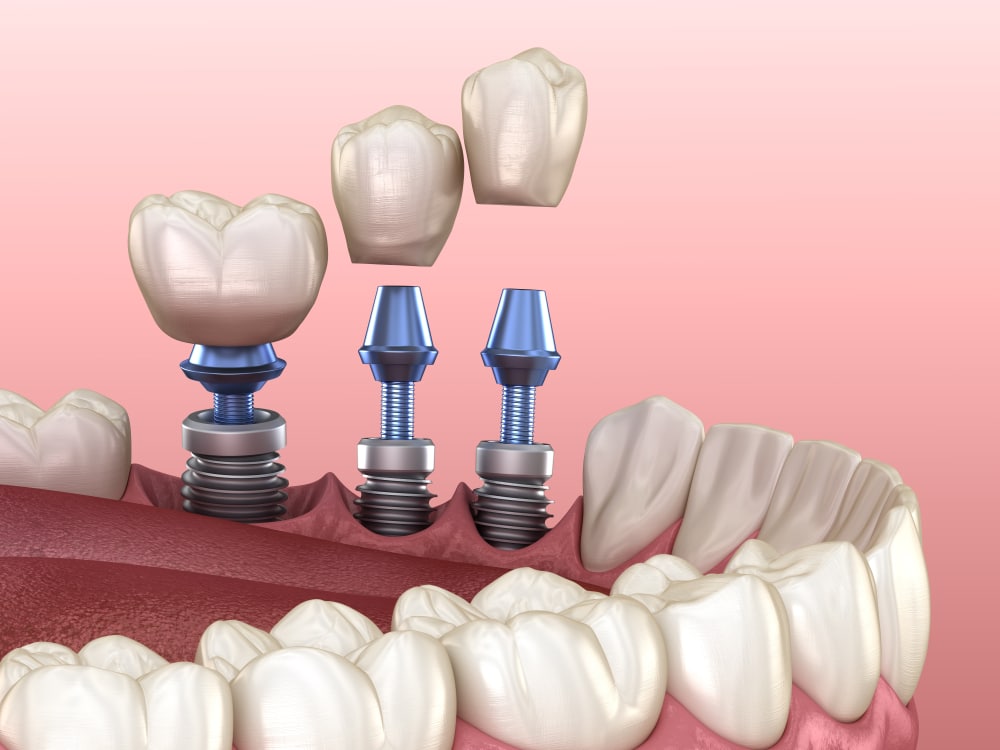

Everything You Need To Know About The Dental Implant Process In Canada

Should I Pull All Of My Teeth And Get Dental Implants

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Dental Implant Cost Dental Implants Start From 900

Dental Implants Financing Monthly Payment Plan Options Best Dental

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

Titanium Vs Zirconia Tooth Implants Cost Without Insurance Properties Pros Cons

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

Dental Implants Financing Monthly Payment Plan Options Best Dental

Full Mouth Restoration Abroad Affordable Total Mouth Dental Implants Crowns Veneers

Full Mouth Restoration Abroad Affordable Total Mouth Dental Implants Crowns Veneers

Dental Implant Costs Pittsburgh Precision Implants

Dental Implants Ident Dental Vaughan Dentistry 905 553 2647